The Opportunity

With AppLovin creating buzz in the DTC advertising space, many are asking:

- Is AppLovin performance truly worth the social media hype?

- Is this channel a worthwhile test or a distraction for scaling brands?

Although AppLovin campaigns for eCommerce have been live for only 1–2 months for most Northbeam customers (and over the peak BFCM period), many marketers are eager to understand its performance through a larger, data-driven lens beyond anecdotal social media buzz. Based on early data, AppLovin shows promise in both activating and reactivating users to drive a high ROAS and new customer percentage:

- Activating New Users: AppLovin’s video ads—integrated into mobile games—capture the attention of users who may have seen your product elsewhere but remain unconvinced. These full-screen, partially unskippable ads (up to 60 seconds) are touted to effectively transition users from passive awareness to meaningful engagement.

- Reactivating Past Customers: AppLovin also performs well at re-engaging past customers. With Northbeam’s tracking, which allows an infinite lookback window, we’ve identified cases where users with 100+ touchpoints made purchases just minutes after viewing an AppLovin ad. This suggests a unique ability to reignite action among lapsed customers.

With Northbeam’s advanced tracking capabilities and deterministic data approach, we can provide an unbiased look at how AppLovin performs for real brands in real campaigns.

Adoption Stats

Early adoption rates suggest that AppLovin has gained rapid traction as a viable channel for DTC brands:

- 75% of Northbeam’s top 100 spending DTC brands are active on AppLovin.

- Over $10M in AppLovin spend has been tracked through Northbeam, with several brands exceeding $1M in spend over the past two months.

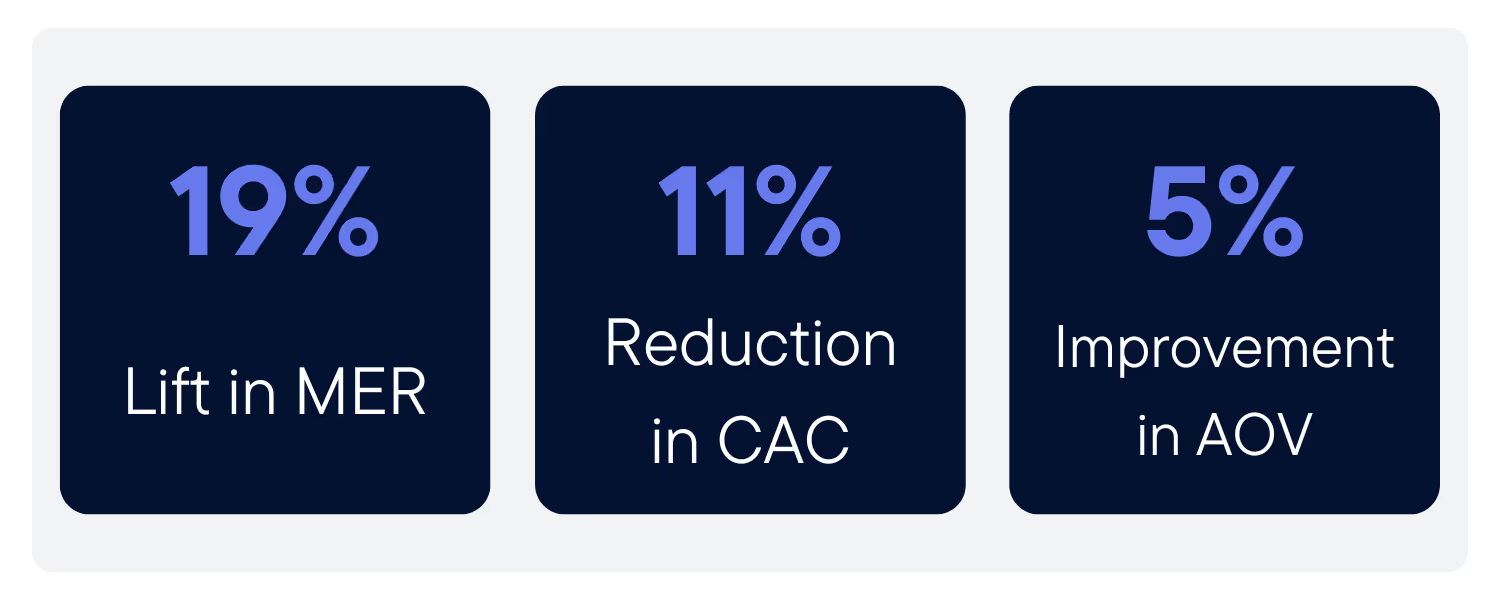

Performance Overview

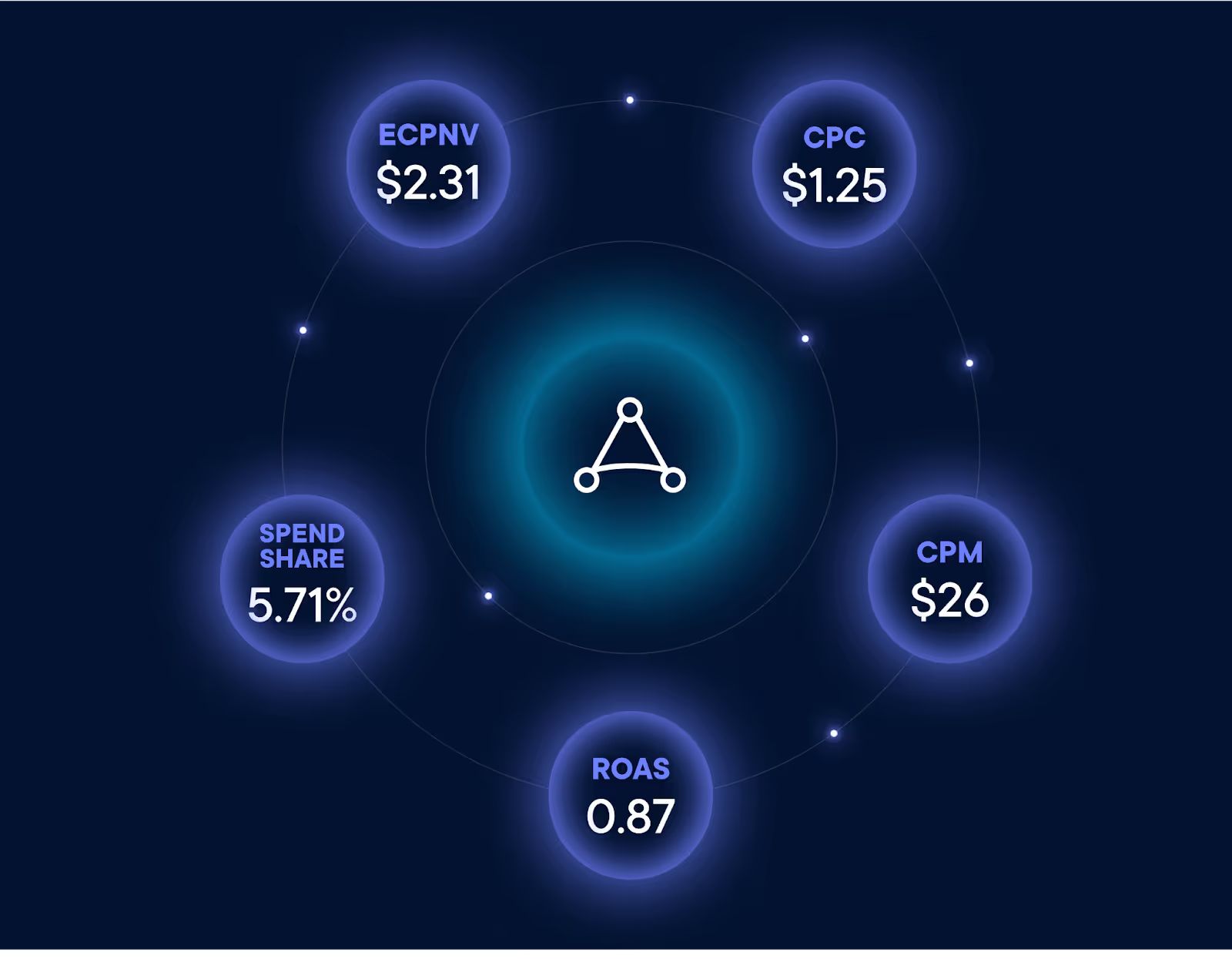

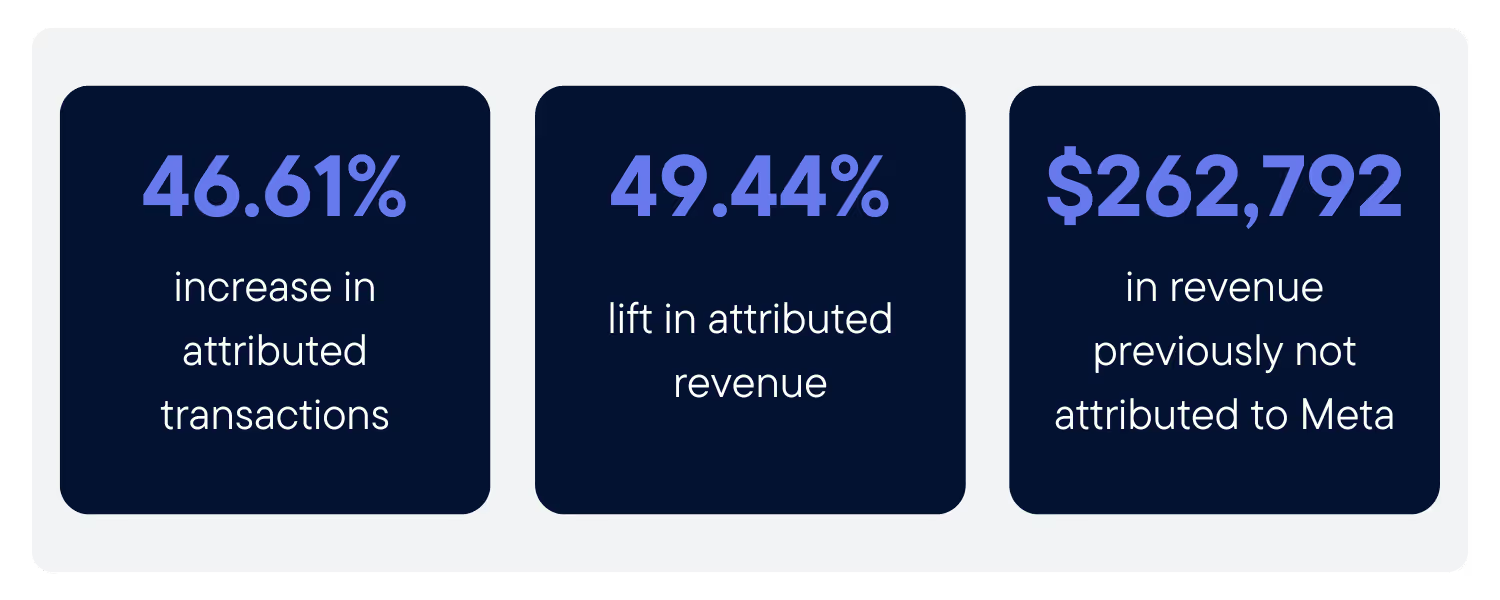

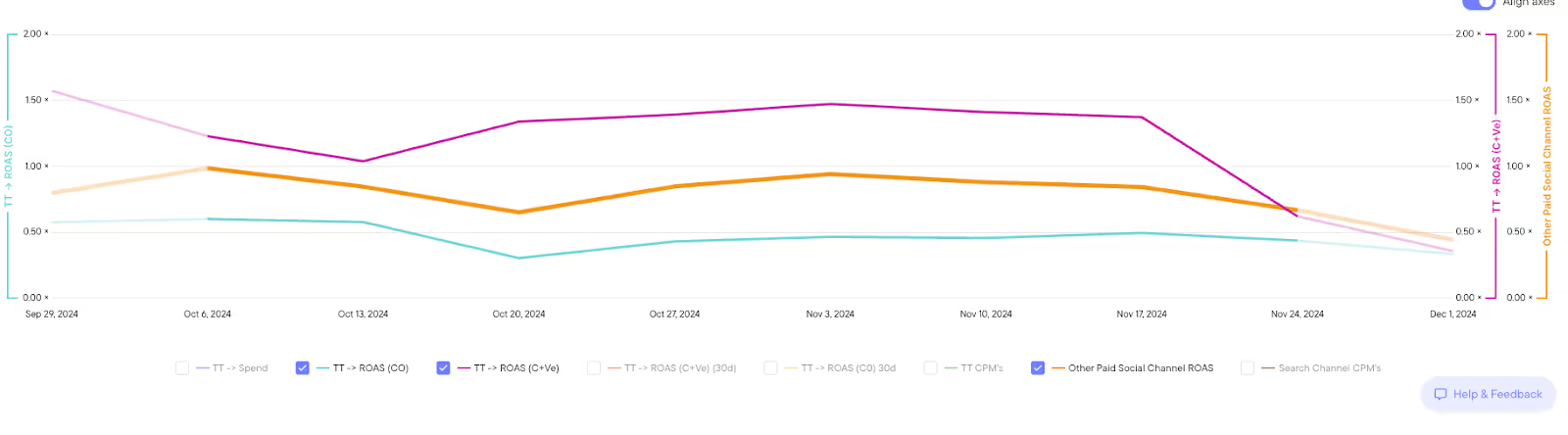

The following data was sourced from Northbeam clients who spent advertising dollars on AppLovin between October 1st and November 30th. All figures are based on Northbeam’s clicks-only attribution model (Multi Touch Attribution), reflecting a clear and conservative view of performance.

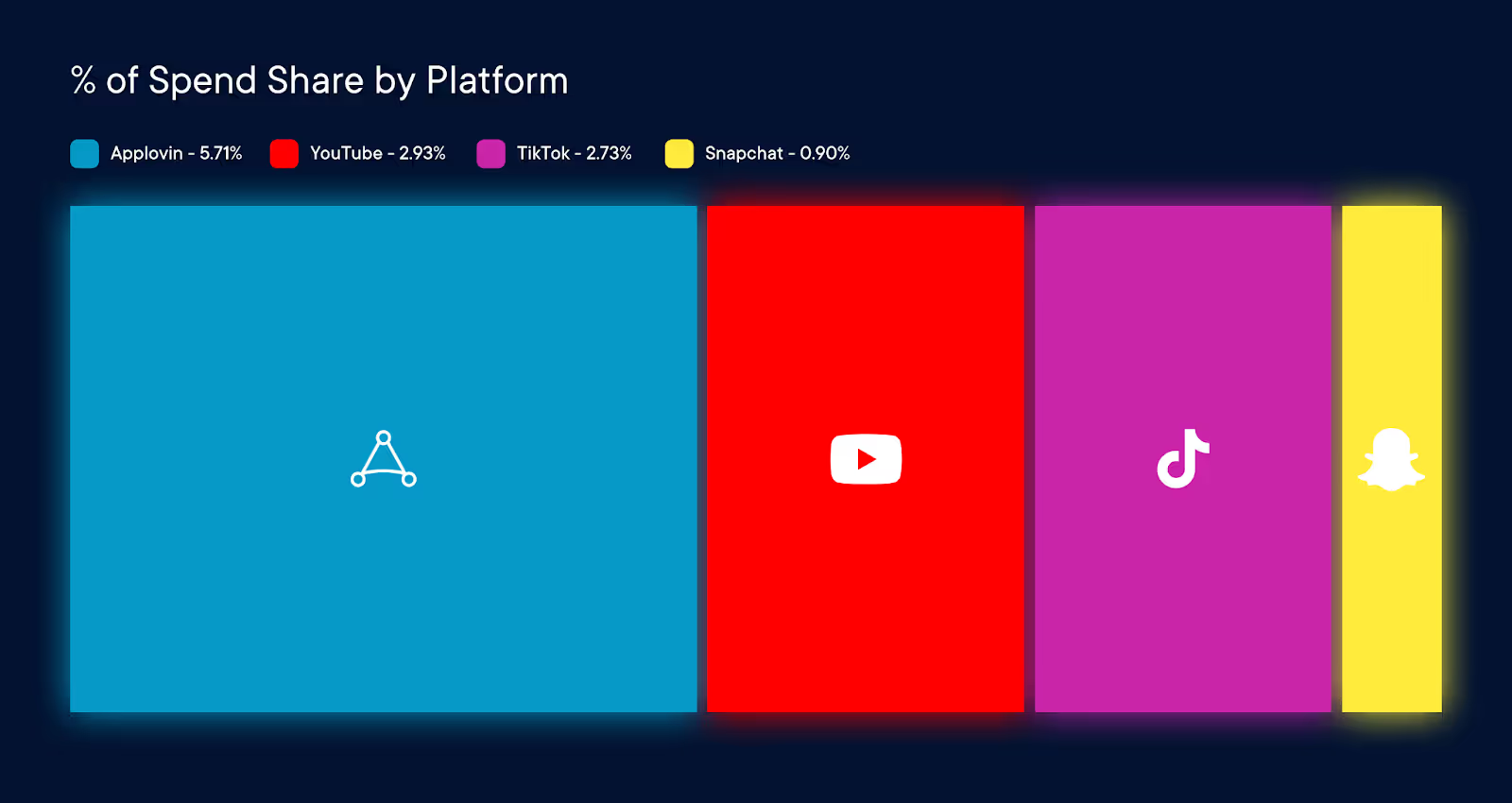

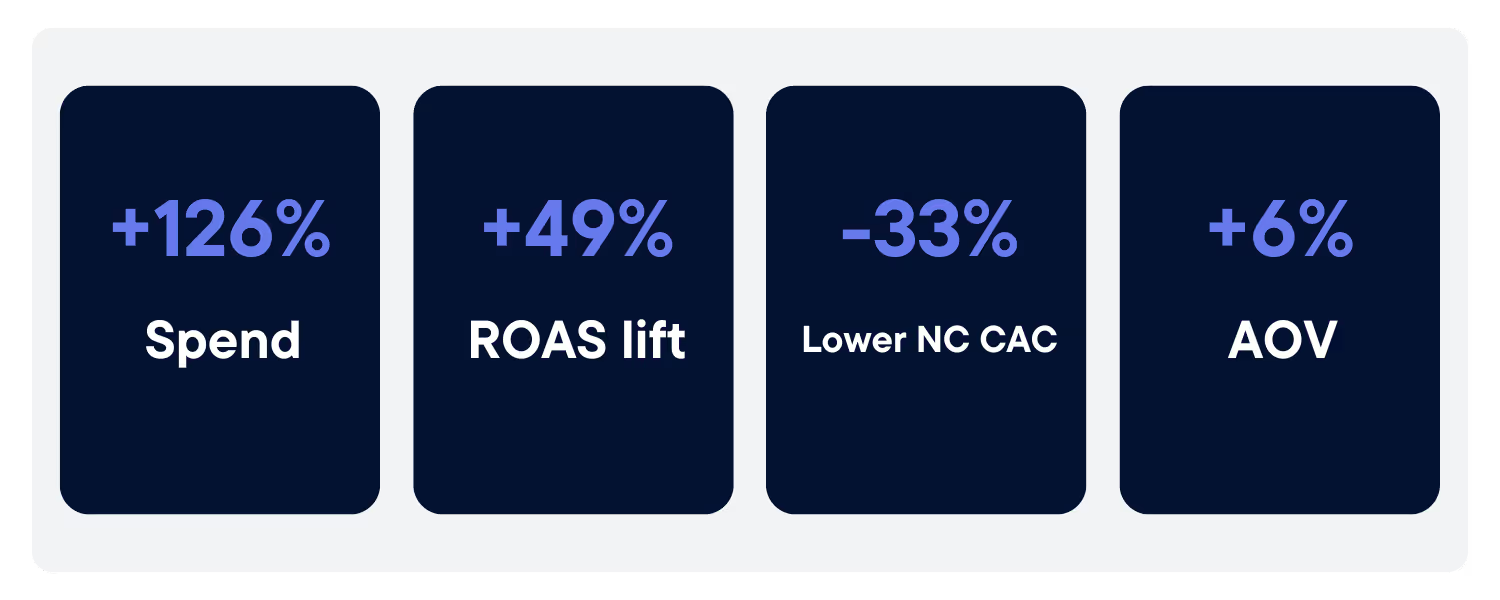

Share of Wallet

- While Meta still leads with a 63% share of wallet across Northbeam's customer base, AppLovin accounts for 5.71% of total budgets among brands live on the platform—outpacing other channels like TikTok, Snap, YouTube, and Pinterest.

- In November, AppLovin captured 10%+ of ad spend for 31 brands, with one brand allocating as much as 34% of their budget to AppLovin.

- Brands spending on AppLovin grew their overall media budgets an average of 125% YoY, with AppLovin playing a key role in this expansion.

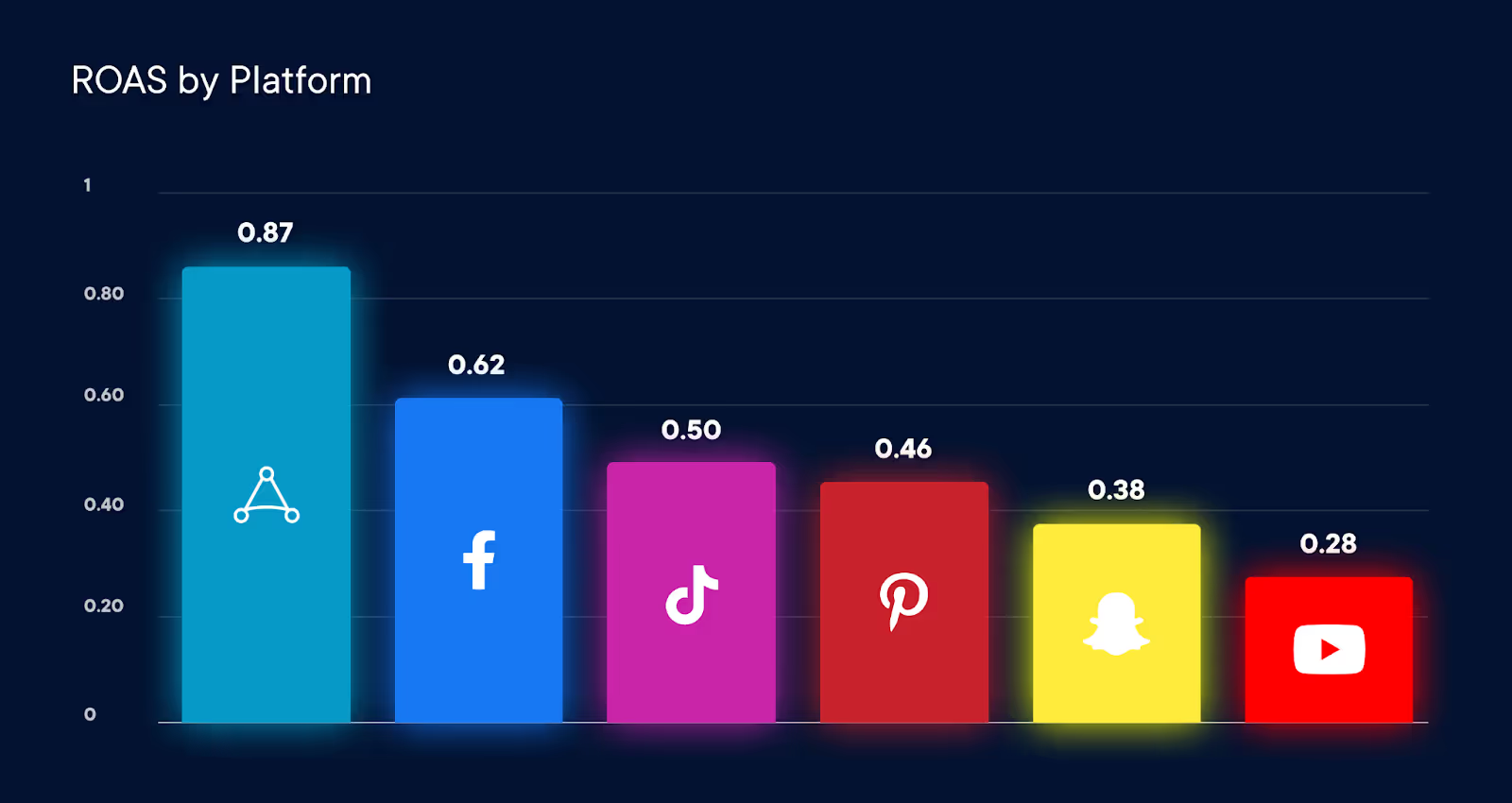

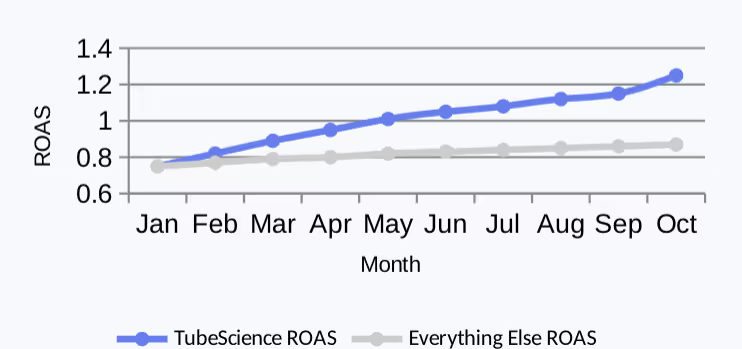

ROAS (Return on Ad Spend)

- AppLovin’s average ROAS is 45% higher than Meta and 74% higher than secondary platforms like TikTok, Snap, YouTube, and Pinterest. The platform’s click-driven nature contributes significantly to these strong performance metrics

- While 1-day efficiency is high on AppLovin, other channels tend to have a larger lift in ROAS when using longer attribution windows. This suggests that most of AppLovin’s impact is driven on the day of the conversion, while platforms like Snapchat, Youtube, and Tiktok can take 7-14 days to achieve comparable ROAS. Not necessarily a bad thing, but important to keep a close eye on as this can vary from brand to brand.

- With increased platform saturation, we expect efficiency to decrease over time. However, for now, AppLovin is performing well for Northbeam users testing this channel. It is important to note that there is still limited understanding of the long term impact of AppLovin due to the channel being so new. Brands leveraging Northbeam will be able to measure the channel holistically across historical benchmarks on other platforms to get a better understanding of long term value.

New Customer % and New Visit %

- AppLovin delivers 39% higher nROAS than Meta and 100%+ higher than secondary platforms.

- Strong ability to drive new customer acquisitions; with 85% of purchases coming from 1st time customers. This is key as click data is conservative, so this is especially validating that performance isn’t fluff and is actually driving acquisition.

- However, AppLovin’s New Visit Rate of 55% is lower than Meta (65%) and secondary platforms (~70%). This indicates the platform may currently target narrower, more familiar audiences. Despite this, it appears to convert first-time customers at a more efficient rate than other platforms.

- Customer acquisition is a key metric for most DTC brands, but it’s crucial to identify which channels are most efficient at converting first-time customers vs channels that are better at driving highly qualified new visits to your website.

- Understanding the complexities of your business is essential for gaining clarity on your customer journey and the time it takes for a customer to make a purchase after their first exposure to your brand. Brands with complex products or higher AOV, such as those in luxury, electronics, or furniture, typically experience longer consideration periods. This underscores the importance of balancing both short-term and long-term impacts in your decision-making process.

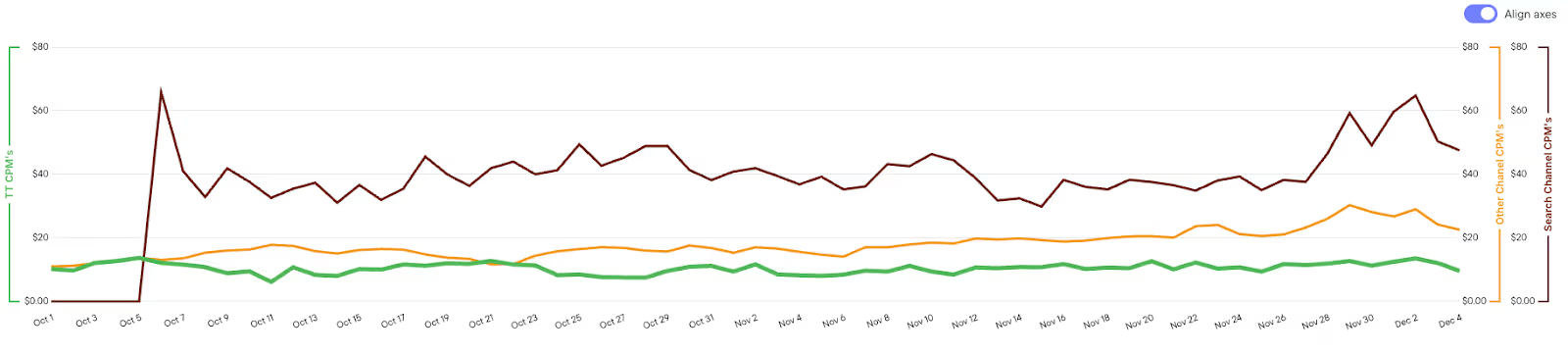

CPMs

- On average, AppLovin’s CPMs are 3.95% lower than Meta’s, but more than 20% higher than secondary platforms. Given AppLovin’s currently smaller share of wallet, it’s likely that as brands continue to scale CPMs are expected to be higher than Meta.

- While CPMs are a decent gauge for traffic efficiency, higher CPMs are commendable for higher quality audience and performance.

- As AppLovin spend and adoption increase in the DTC space in 2025, it will be interesting to observe how auction prices are impacted and if they can remain as competitive as Meta at scale

Why It’s Working

AppLovin’s new eCommerce offering shows promise as an alternative marketing channel for DTC brands seeking to diversify beyond Meta. Its ability to activate new users and reactivate past customers fills a crucial gap for brands aiming to scale.

AppLovin is currently highly competitive in terms of auction costs, with a large volume of clicks on the platform driving new customer conversions. This has contributed to strong overall performance to date and something to keep a close eye on with increased spend volume.

Northbeam users have quickly scaled on AppLovin by leveraging real-time performance insights powered by our first-party data and machine learning. With Northbeam’s accrual accounting methodology, brands can set 1-day profitability benchmarks aligned with their long-term objectives. This approach has allowed brands to assess the immediate impact of AppLovin in comparison to other channels, while continuing to get a deeper understanding of its full impact over time.

Customer Sentiment

Although AppLovin is seeing strong performance within Northbeam, our customers have had various opinions on the channel thus far:

- “AppLovin seems to be outperforming most channels, but will this last?”

- “We’re cautiously optimistic but impressed so far. The results are undeniable.”

- “AppLovin ROAS looks impressive, but I’m worried it’s just retargeting users.”

Concluding Thoughts from Northbeam

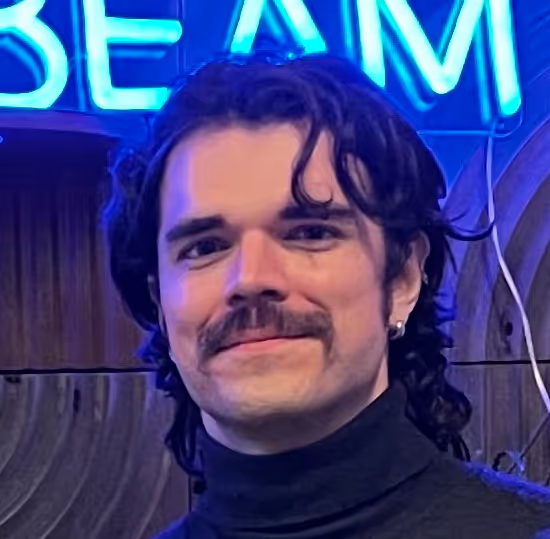

Northbeam’s Head of Media Strategy, Ryan Kovach, reflects on AppLovin’s role in reshaping channel diversification for DTC brands:

- Optimistic but Measured: Early results show AppLovin’s potential, with strong ROAS and nROAS positioning it as a channel worth considering for expanding media budgets.

- Demand Generation Excellence: AppLovin offers an intriguing combination of scale and performance, with early signs of capturing 10%+ of overall ad spend for several brands.

- Areas for Improvement: Metrics like New Visit Rate raise questions about audience diversity and potential future saturation, but its performance on ROAS and customer reactivation make these concerns secondary.

Guidance for Marketers

- Leverage Northbeam’s data quality for precise tracking:

- Use Northbeam to track both clicks and view-throughs on AppLovin, providing deterministic measurement of how the channel interacts with others, across devices, and throughout the customer journey.

- Monitor key performance metrics like CPMs, CAC, ROAS, and nROAS to assess scalability.

- Consider AppLovin for both demand acquisition and customer re-engagement campaigns.

- Set profitability benchmarks tailored to AppLovin with Northbeam:

- Establish CAC payback period targets to align with your brand’s goals and optimize campaigns down to the creative level.

- Use New Visit % and New Customer % to validate audience quality.

The Road Ahead

AppLovin’s managed-service model is currently limited to brands spending $20K+/day on Meta, but its self-serve platform launch in 2025 promises broader accessibility. Stay tuned for more analysis- Northbeam will continue refining insights with additional data pulls and case studies in early 2025, including:

- Channel Overlap (Touchpoint Data)

- First-Touch Attribution Comparisons

- Analysis of Brands Allocating Higher Spend Shares

- View-Through Measurement with Enhanced Clicks + Views

As DTC brands increasingly adopt AppLovin, its focus on activating and reactivating users positions it as a promising channel for 2025 and beyond.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.svg)